Commerce subjects..

By creating this blog ,I give short easy notes on Commerce subjects (Business studies, Economics,Accounts).

Sunday, 31 March 2024

What are the Main Factors that Influence Working Capital?..

Thursday, 10 August 2023

Introduction to Micro Economics and Macro Economics.

|

| Economics |

Q1) What is Economics?

"Economics is the study of finding solutions of making choice between unlimited wants with limited resources."

1) Micro Economics

2) Macro Economics

1) Micro Economics - When we study the economic behaviour of individuals like Customer,Producer,firm , company that is Micro Economics.Micro economics is the study of small unit .In this we study how the individuals make choices of wants among unlimited wants and satisfied with limited resources so that they can get maximum satisfaction.In Micro Economics we study the demand, supply of particular individual.Micro economic's basic tool is price because all the decisions are taken by taken price in a consideration for eg consumer demand more good if the price is less and less goods if price is high.In the way producer also take price in consideration and make choice for eg if price of product is high producer supply more goods and if price is low producer supply less goods .Thus price is the basic phenomenon of Micro Economics.

|

| Micro Economics |

2) Macro Economics - When we study Economic behaviour of whole country or nations that is macro economics.In this we study how government make choices among unlimited wants of people with limited resources because Government revenue is limited but people wants are unlimited .In this we study the national income, Employment level , Production level, Standard of living, general price level.national savings etc.

|

| Macro Economics |

Macro economics basic tool is income because all the decisions are taken on the basis of income .It means income is the basic phenomenon of macro economics.In macro economics level of employment,level of standard of living, level of savings all are based on income . Government choose option on the basis of income.

Difference between Micro and Macro Economics....

1) Study- Micro Economics is the study of individuals,Whereas Macro Economics is the study of overall aggregate of economy.

2) Deals- Micro Economics deals in individual demand and supply, Whereas Macro Economics covers the market demand and supply.

3) Parameter- Price is the basic parameter of micro economics, Whereas Income is the basic parameter of macro economics.

4) Complex- Micro Economics analysis is simple, Whereas Macro Economics is complex due to study of large groups.

5) Tools- Individual demand and individual supply are the basic tools of micro economics, Whereas aggregate demand and aggregate supply are the basic tools of macro economics.

6) Examples - Demand, supply, production are the examples of micro Economics, Whereas total employment,total savings, level of standard of living are the examples of macro economics.

Thank you ☺️

Diya Chhetija

www.chhetija.diya@gmail.com

Thursday, 22 September 2022

Finance management, Relationship of financial management with related disciplines, Pervasive nature of finance function.. ,

|

| Capital structure |

|

| Management of cash.. |

Relationship of Financial Management with related disciplines.

Pervasive nature of finance function..

Sunday, 18 September 2022

Financial management,Objectives of Financial Management, difference between profit maximization and value maximization.

|

| Financial management |

Objectives of Financial Management...

Profit Vs Wealth Maximization

Wednesday, 14 September 2022

Price Elasticity of Supply..

Meaning of Price Elasticity of Supply:

Types of Elasticity of Supply..

|

| Inelastic supply or less elastic supply |

|

| Unitary Elastic supply |

|

| Elastic supply or highly elastic supply |

|

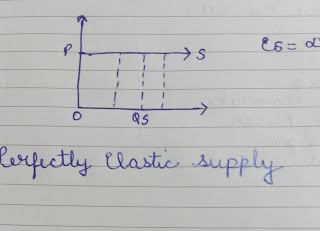

| Perfectly elastic supply |

Monday, 12 September 2022

Coordination...

|

| Coordination |

Coordination..

Coordination is ..

Types of Coordination..

Techniques of maintain Coordination between different activities and departments in the enterprise are these:-

Characteristic features of Co-ordinating...

How Coordination is different from Co-operation?

Essentials of Coordination..

Thursday, 1 September 2022

Financial Planning, Capital Structure, financial Leverage, Capitalization, Relevance of the time value of money in financial decisions.

|

| Financial Planning |

Capital Structure...

Features of Capital Structure...

Financial Leverage...

Factors affecting Capital Structure:

Capitalization -

Q1 Explain the relevance of time value of money in financial decisions?

Commerce Subjects

What are the Main Factors that Influence Working Capital?..

Working Capital Management... The Capital required to meet day to day expenses of a business is termed as working capital.It comprises of t...

-

Supply Supply meaning... Supply is the amount of a product that a producer is offering for sale at a given price during a given perio...

-

Organising ... Organisation -The term organisation means group of persons joint together systematically contributing their efforts ...

-

Business management Business Management... Management means to manage,it means manage the activities.Management is ...